Fourth quarter earnings season unofficially kicks off this week with a dozen banks and asset managers in the S&P 500 slated to report. Results will come from some big names, including JPMorgan Chase (JPM) on Tuesday; Bank of America (BAC), Wells Fargo (WFC) and Citigroup (C) on Wednesday; and Blackrock (BLK), Goldman Sachs (GS), and Morgan Stanley (MS) on Thursday. After these and the rest of the results are in, we believe there could be a continuation of an impressive streak of quarters with double-digit earnings growth, expanding profit margins despite tariffs, and another quarter of strong earnings growth from the technology sector and the AI buildout.

Low Teens Looks Like a Low Bar

Regular readers of our earnings commentaries know how this usually goes. Companies guide earnings estimates low enough so they can beat them. If the economy doesn’t take an unexpected turn, history tells us S&P 500 companies will be able to grow earnings at least 3% faster than estimates, though past performance does not guarantee future results. In recent years, the amount of upside has typically been 6% or more.

Source: LPL Research, FactSet, 01/08/26

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

Two other reasons to be confident. First, artificial intelligence (AI) investment, which is expected to drive most of the earnings growth for the quarter, isn’t slowing down. And second, the average level of the U.S. Dollar Index was down more than 5% from the year-ago quarter, boosting earnings generated in foreign currencies by U.S. multinationals operating abroad.

AI Investment Remains the Dominant Earnings Driver

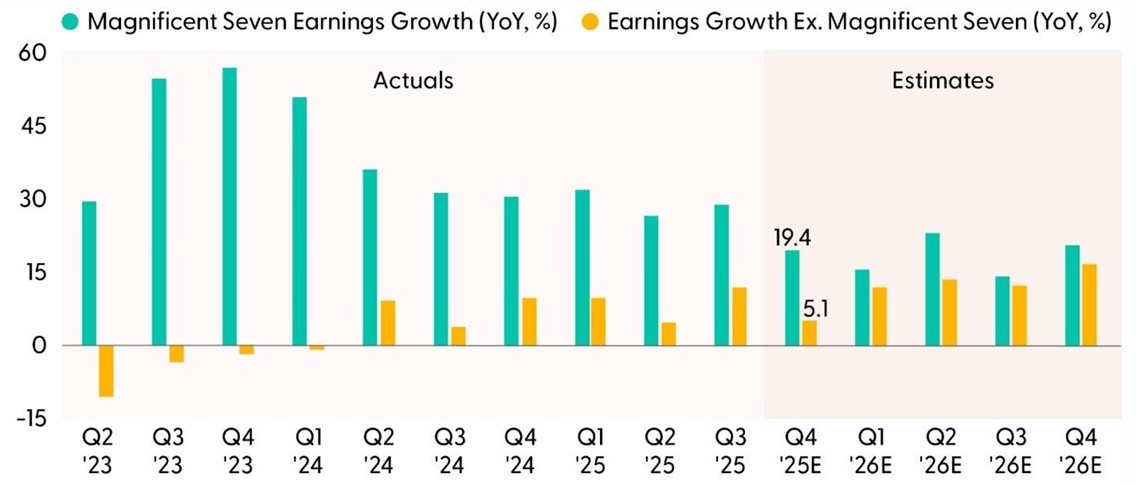

AI names, including the Magnificent (Mag) Seven, will again be a significant driver of earnings growth in the fourth quarter. Based on current estimates, about 80% of the 8% expected S&P 500 earnings growth for the quarter will be driven by the technology sector, which excludes several leading AI players including Alphabet (GOOG/L), Amazon (AMZN), and Meta (META). The sector will likely grow its earnings in Q4 by more than 30% when all the numbers are in, though current consensus is 25.8%.

Slicing this another way, the biggest six technology companies, i.e., the Mag Seven excluding Tesla (TSLA), are expected to drive over 60% of S&P 500 earnings growth for the quarter by growing earnings an average of 19%. That pace of growth from this group, which may end up north of 25% when all the results are in, will probably more than double the earnings growth rate that the “S&P 493” will be able to deliver. Growth outside of these top technology oriented companies has improved slightly in recent quarters and may reach double-digits again (the 493 grew earnings 11.8% in Q3 2025), but the key AI players may continue to deliver the most growth for at least the next few quarters.

This earnings growth gap supports LPL Research’s continued preference for large growth equities over their large value counterparts. But, as the gap potentially narrows in 2026, the bull market may broaden out. Cyclical value stocks, which have performed relatively well in recent months as technology has sputtered some, may get additional support from the fiscal stimulus prescribed by One Big Beautiful Bill Act (OBBBA). One of the sectors on our shopping list for 2026, industrials, fits this theme.

Magnificent Seven Remains a Powerful Earnings Contributor

Source: LPL Research, Bloomberg, 01/08/26

Disclosures: Magnificent Seven includes Alphabet (GOOG/L), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA). All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

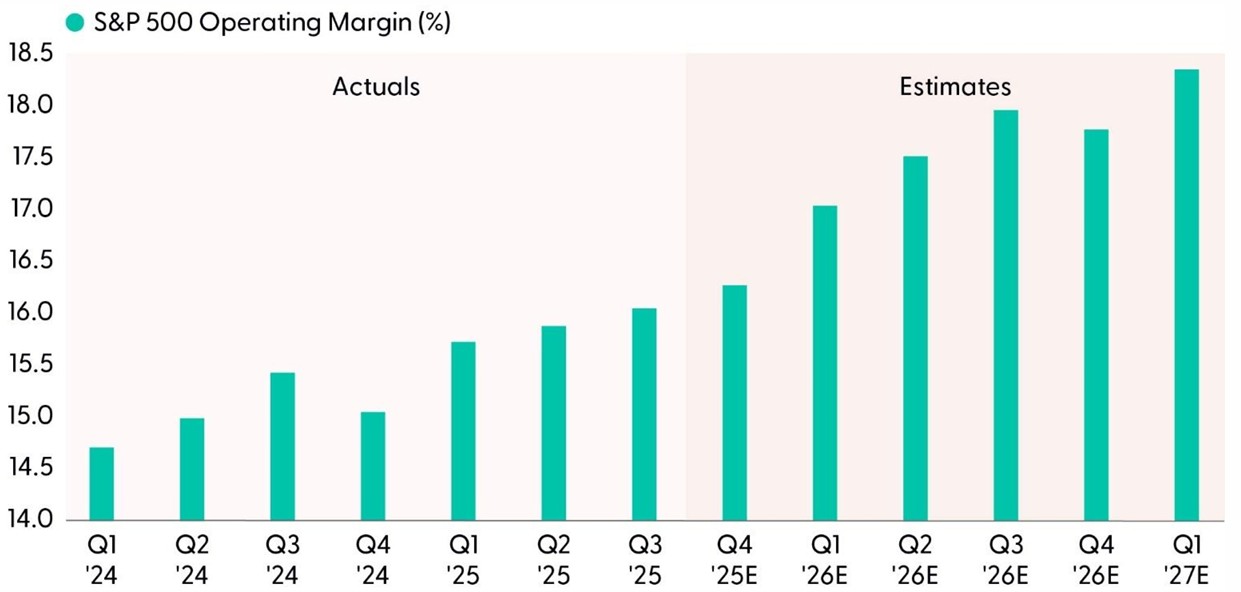

Tariffs Didn’t Hit Hard Enough to Be Much of a Headwind for Profit Margins

One potential earnings headwind, which has been with us for a couple of quarters now, is the additional cost of tariffs. Companies have done such a spectacular job managing tariffs thus far, expanding margins over the last four quarters, that this should not be particularly worrisome. The overall effective tariff rate is not expected to move much from the 10% to 11% range it’s been in over the last three months. And even if the tariffs imposed under the International Emergency Economic Powers Act (IEEPA) are ruled illegal by the Supreme Court, the Trump administration is expected to put them back on promptly using a different legal authority.

So, with solid and steady economic growth, strong AI-fueled technology earnings, a weak dollar, and manageable and stable tariffs, corporate America has an excellent opportunity to deliver low-teens earnings growth in the fourth quarter. The 7% upside produced in the prior quarter may be too much to ask for in Q4 (and we probably won’t exceed Q3’s near-record 82% beat rate), but even 5% or 6% upside would get us to an impressive 13% to 14%.

Profit Margins Marching Higher Despite Tariffs

Source: LPL Research, Bloomberg, 01/08/26

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

Strong Earnings Outlook For 2026

As always, we want to pay more attention to management guidance for future quarters than the backward-looking results from the end of 2025. In general, we expect management commentary to be positive given steady economic growth, the continuation of huge AI investments, and the OBBBA stimulus. Lower tariffs and greater trade policy clarity are also helpful.

LPL Research expects GDP growth of 2% in 2026, with slower growth in the first quarter followed by a pickup beginning in the second as stimulus kicks in. That growth, combined with pricing power reflected in inflation expectations, is more than enough to propel mid-to-high single digit revenue growth in 2026, in our opinion. Consensus expects S&P 500 revenue growth of 7% this year.

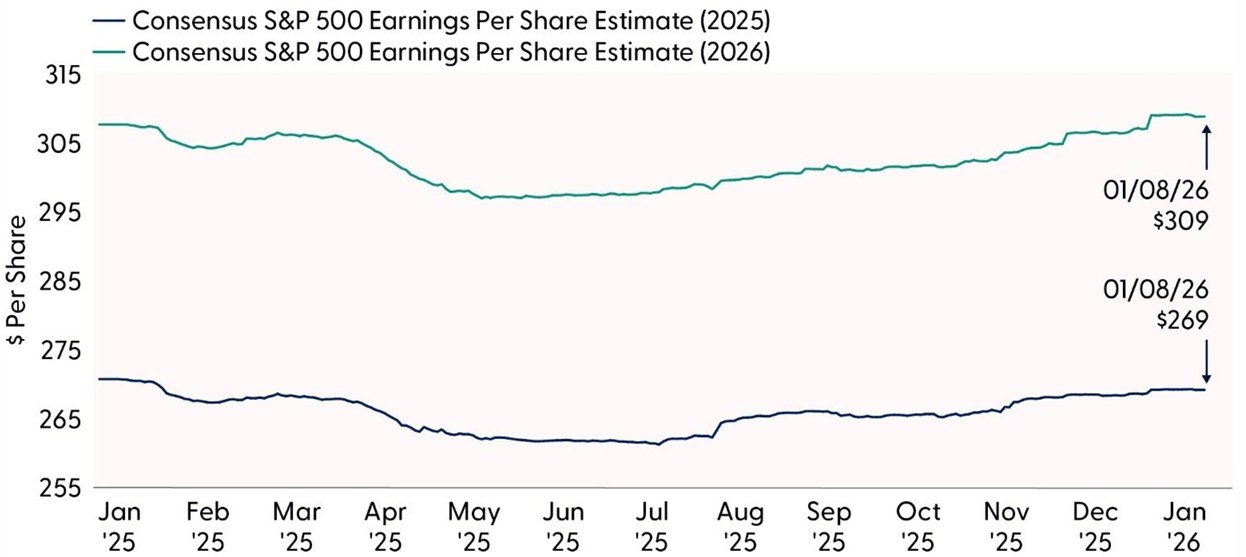

The power of the AI trend is apparent in the rise in future earnings estimates in recent months—an unusually positive development. Consensus estimates for capital investment from the five main hyperscalers—AMZN, GOOG/L, MSFT, META, and ORCL—call for a 30% increase in 2026, a huge earnings tailwind.

Meanwhile the stimulus hasn’t kicked in yet but will soon. Roughly $270 billion in 2026 stimulus via business tax incentives and consumer tax cuts and other savings will start flowing through next month, bolstering the outlook for consumer and industrial companies (we prefer the industrials sector over consumer discretionary currently).

Our forecast of $290 in S&P 500 earnings per share (EPS) in 2026, up from our prior forecast of $280, represents about 7.5% increase from where 2025 is likely to land. That forecast is well below consensus forecasts in the $305 to $310 range, depending on the source, which reflects earnings growth in the mid-teens.

Our more conservative estimate provides some cushion in terms of the remaining tariff increases that are likely in 2026, regardless of the Supreme Court ruling on tariffs. We expect the Trump administration to enact tariffs using a different legal authority if needed. Our below consensus earnings estimate also reflects more conservative forecasts for consumer spending given the slowing job market and a slow pace of AI adoption that pushes some productivity gains into 2027.

Bottom line, double-digit earnings growth is possible in 2026, which can provide a strong foundation for higher stock prices. Our forecast of $320 in S&P 500 EPS in 2027, on which our 7,300 to 7,400 S&P 500 year-end fair value target is based, reflects some acceleration from higher productivity from AI adoption.

Earnings Estimates For 2026 Have Continued Their Ascent

Source: LPL Research, FactSet, 01/08/26

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

Conclusion

As we wrote in our 2026 Outlook, and as we’ve already observed so far in this young new year, 2026 is going to be a lot about policy. Fiscal policy will help drive growth. Regulatory policy will likely help certain segments of the economy. And monetary policy support is expected to continue. Expect that macroeconomic backdrop to be supportive of corporate profits.

The microeconomy will also play a huge role in determining how fast overall earnings grow in 2026 and how those expectations affect stock prices. AI investment will provide a strong earnings tailwind again this year and likely well beyond. Companies must continue to drive margin expansion despite tariffs. Consumers must continue to spend even as the job market slows.

Stocks will surely have their ups and downs this year around fluctuations in economic growth, policy changes, and scrutiny on the massive AI investments. We just wouldn’t bet against corporate America delivering solid results through 2025 and 2026. Earnings should be good enough throughout this year to help mitigate the depth of the selloffs and enable stocks to at least deliver high-single-digit returns (even though we know returns in line with long-term averages in a given year are rare). We believe mid-teens appreciation in stocks this year is possible if AI adoption accelerates and delivers strong productivity gains.

Asset Allocation Insights

LPL’s STAAC maintains its tactical neutral stance on equities as 2026 begins. Investors may be well served by bracing for occasional bouts of volatility given how much optimism is reflected in stock valuations, but fundamentals remain broadly supportive. Technically, the broad market’s long-term uptrend remains intact, leaving the Committee biased to buy potential dips that emerge.

STAAC’s regional preferences across the U.S., developed international, and EM are aligned with benchmarks, though an improving technical analysis picture in EM is noteworthy. The Committee still favors the growth style over its value counterpart, large caps over small caps, and the communication services sector, and is closely monitoring the healthcare, industrials, and technology sectors for opportunities to potentially add exposure on weakness.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for MBS over investment-grade corporates. The Committee believes the risk-reward for core bond sectors (U.S. Treasury, agency MBS, investment-grade corporates) is more attractive than plus sectors. The Committee does not believe adding duration (interest rate sensitivity) at current levels is attractive and remains neutral relative to benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0006529-1225 Tracking #846599 | #847614 (Exp. 1/27)