As 2024 draws to a close, investors have fully embraced the stock market. The S&P 500 is up more than 25% year to date. The broader Russell 3000 Index is up 24%. The Nasdaq Composite is up over 31%. Even the laggards are up double-digits with 12% and 14% advances for the small cap Russell 2000 and the Dow Jones Industrial Average. Volatility was low, with a maximum peak-to-trough decline for the S&P 500 of 8.5% (the long-term average max drawdown is over 13%). As we turn our attention to 2025, the supports of the past year largely remain in place, but some additional pillars have been added as we discuss below.

Setting the Stage

As the stock market wraps up a strong 2024, and we look ahead to 2025, the economic foundation remains in good shape. Corporate profits are rising, and the Federal Reserve (Fed) is expected to continue cutting rates next year, which will likely keep the current bull market on track. But investors will have to grapple with a market pricing in a lot of good news. Positive surprises that drove stocks higher in the last year may be more difficult to come by in the year ahead. Inflation pressures are lingering, interest rates are rising, and geopolitical threats are significant. Here we walk through our four keys to a strong 2025 for stocks.

#1 No Recession

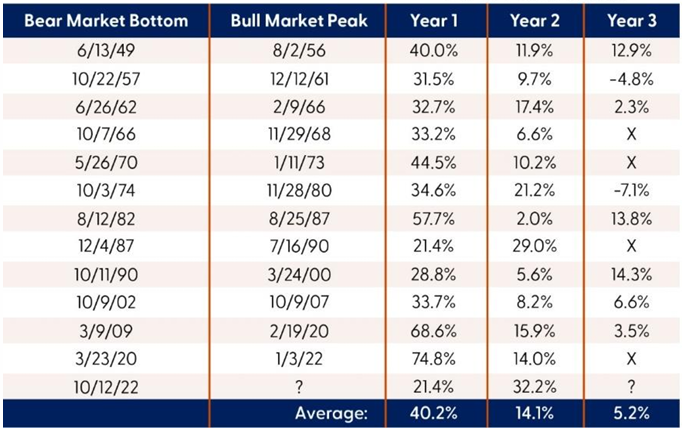

The bull market, which has entered its third year, has advanced more than 67% since it began on October 12, 2022. History suggests that this bull market has a good chance of celebrating its third anniversary. The following table illustrates that in the absence of recession, the odds that a two-year-old bull market gets to three are quite good. For bull markets that get through year three, the S&P 500 has gained an average of 5.2%. The bulls that didn’t make it through a third year were ended by recessions, an overly aggressive Fed, or, in the case of 1987, excessive speculation. We believe the chances of another positive year in 2025 are favorable given the high probability of economic growth and a Fed that is likely to cut rates next year (LPL Research expects at least two cuts in 2025). But if resurgent inflation takes rate cuts off the table or speculation gets out of hand, this bull market could have a difficult time making it through next year.

In the Absence of Recession, Year Three Bulls Tend to Be Good For Stocks

Year-by-year bull market performance

S&P Index Returns

Source: LPL Research, FactSet, 12/24/24

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. The modern design of the S&P 500 Index was first launched in 1957. Performance before then incorporates the performance of its predecessor index, the S&P 90.

#2 A Supportive Federal Reserve

A more hawkish Fed on December 18 caused the bond market to reduce its 2025 expectations to less than two 0.25% rate cuts, down from nearly three before the meeting. Stocks certainly expressed their displeasure, with the S&P 500 falling 2.95% in response, the biggest one-day selloff on Fed Day since 2001. Until then, stocks had adjusted well to the dramatic shift in rate expectations throughout 2024. Recall, markets were pricing in more than six cuts for 2024 entering the year.

The path forward may get tougher. The pace of disinflation has slowed as economic growth has continued to surprise markets and the Fed (the Atlanta Fed’s GDP tracker for the fourth quarter sits at a very strong 3.1%). Support from fiscal policy increases inflation risk. With rich stock valuations, extreme bullish sentiment, and elevated interest rates, there may not be much more room for disappointment.

Still, LPL Research’s base case remains for at least two cuts next year as inflation comes down further, which should be good for stocks. The S&P 500 has produced modest gains of 5.5%, on average, during the 12 months following the initial cut of a Fed cycle, with gains typically double that in the absence of recession.

Stocks Usually Rise After Fed Rate Cuts Begin

S&P 500 performance after start of Fed rate cutting cycles

Source: LPL Research, Federal Reserve, Bloomberg, 12/26/24

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

#3 Corporate America Must Continue to Deliver Strong Earnings Growth

When valuations are as high as they are currently, earnings growth is typically required to lift stock prices. Expect 2025 to be one of those years. Corporate profits carry the potential to grow at a double-digit pace, backed by steady but slower economic growth, limited wage inflation, artificial intelligence (AI) investment and related productivity gains, and deregulation.

Tariffs present perhaps the greatest risk to profits because of the potential impact on profit margins and the likelihood of retaliation by our trading partners that could restrain overseas revenue for U.S. multinational corporations. Meanwhile, higher interest rates could slow profit growth next year, though the effects would likely be limited, and wage pressures from a tighter labor supply due to stricter immigration policies could constrain profit margins.

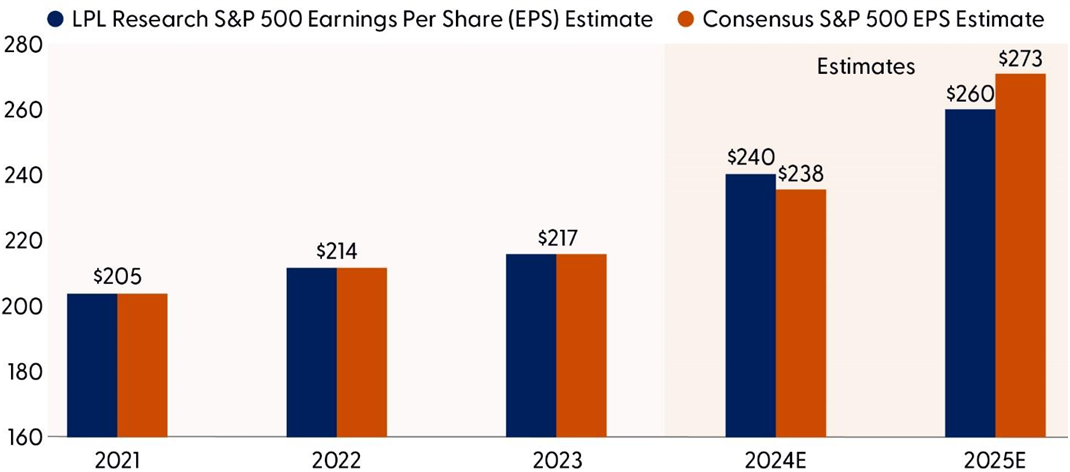

LPL Research’s forecast for S&P 500 earnings per share (EPS) in 2025 is $260, in line with the long-term average earnings growth rate near 10%, but below current consensus estimates near 15%.

For 2026, LPL Research estimates $275 in S&P 500 EPS, about 6% above 2025. Forecasting earnings below consensus is almost always a winning move, but tariff risk in 2025 without any expected benefit from tax cuts until 2026 (if then) underpins our conservativism.

Expect Strong Earnings Growth in 2025 Even If Less Than Lofty Analysts’ Expectations

Source: LPL Research, FactSet, 12/26/24

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Estimates may not materialize as predicted and are subject to change.

#4 Fiscal, Regulatory, and Trade Policy Offers More Upside than Downside

Markets are pricing in a lot of policy optimism for next year. Trump 2.0 is expected to reduce regulations and cut taxes while using the threat of tariffs more than tariffs themselves to achieve policy objectives, including slowing illegal immigration and reducing trade barriers with U.S. trading partners.

The potential upside from a business-friendly regulatory backdrop is clear. We believe markets are correct to expect deregulation to support certain industries, including financial services and oil and gas, and to help foster more merger and acquisition activity. Elon Musk’s and Vice President-elect J.D. Vance’s ties to Silicon Valley may lead to lighter-touch regulation in the technology sector.

Tariff risks are also quite clear. Protectionist trade policy put the “Great” in the Great Depression. Higher import costs hurt profit margins for importers and retaliation can impair growth.

Where we have a harder time is with the market’s enthusiasm for tax cuts. Putting aside the fact that any additional tax cuts wouldn’t go into effect until 2026, we don’t believe Republicans, with a slim majority in the House, will find enough offsetting spending cuts to get any meaningful reduction in corporate taxes.

Extending lower personal tax rates can support consumer spending but won’t have much influence on corporate profits or the stock market next year because the lower rates are already in place. A short-term, four-year extension of the tax cuts (rather than the typical 10 years) to get through Trump’s term is possible because it would be easier to get done but may disappoint markets. We saw during the recent negotiations to fund the government that budget discipline still exists in Congress. Expect this negotiation around the expiring tax cuts to be difficult and drive market volatility as soon as next summer.

Bottom line, for stocks to enjoy a good year in 2025, policy from the Trump administration will have to deliver more benefits than costs.

Conclusion

Our four keys to a strong stock market in 2025 include economic growth (no recession), an accommodative Fed, strong profits from corporate America, and fiscal and regulatory policy from the Trump administration that helps more than it hurts. As discussed in our Outlook 2025: Pragmatic Optimism, we expect stocks to move modestly higher next year while acknowledging reasonable upside and downside scenarios. Here we’ve laid out the upside scenario. The most likely downside scenarios involve re-accelerating inflation, higher interest rates, and geopolitical threats that do economic harm.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S. over international and emerging markets, a slight tilt toward growth, and benchmark like exposure across the market capitalization spectrum. However, we do not rule out the possibility of short-term weakness as sentiment remains stretched and a lot of good news is priced into markets despite heightened geopolitical tensions. Equities may also need to readjust to what could be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0002562-1124 Tracking #675697 | #675758 (Exp. 12/25)